There’s truth which many headlines overlook.

Trust us, we know you have a lot of questions right now regarding the real estate market as we head into 2022. (Honestly, the fact that it’s nearly 2022 is incredible to us… time flies!) The forbearance program is coming to an end, we’re seeing mortgage rates starting to rise, and there’s already an influx of worry.

Unfortunately, anyone with a soapbox and audience (from mainstream media to lone bloggers) has realized one important thing:

Bad News Sells

What does that mean? We’ll continue to see a rash of doom and gloom headlines over the next few months. Because bad news spreads like wildfire compared to good, we want to encourage you to turn to reliable sources to give you the right information regarding what to expect from the housing market now, and into next year.

We’ve already seen it… alarmist headlines, front and center beginning to appear. To date the most common ones are below.

1. Foreclosures Are Spiking Today

Some truth, but mostly not. Like we said – there are those who are trying to stretch the bad news to have something to talk about.

You may have seen various headlines circulating which call out the rising foreclosures in today’s real estate market. These stories are fundamentally flawed, and this is why:

They are focusing on an overly narrow view – the current volume of foreclosures compared to 2020, and emphasizing that we’re seeing far more foreclosures this year compared to last.

Panic inducing, right?

Hold on just a sec. The truth: it’s true foreclosures have been up over the 2020 numbers, but it’s important to consider that there were virtually no foreclosures last year because of the forbearance plan.

For instance, comparing September 2021 to September of 2019 (the last “normal” year), foreclosures were down 70% according to ATTOM.

Even Rick Sharga, an Executive Vice President of the firm that issued the report referenced in the above article, says:

“As expected, now that the moratorium has been over for three months, foreclosure activity continues to increase. But it’s increasing at a slower rate, and it appears that most of the activity is primarily on vacant and abandoned properties, or loans in foreclosure prior to the pandemic.”

Homeowners who were impacted by the pandemic are not generally the ones being burdened right now, and that’s because the forbearance program has worked.

Ali Haralson, President of Auction.com, explains that the program has done a remarkable job:

“The tsunami of foreclosures many feared in the early days of the pandemic has not materialized thanks in large part to the swift and decisive foreclosure protections put in place by government policymakers and the mortgage servicing industry.”

Meanwhile, the government is making sure homeowners are given, and have, every opportunity to stay in their homes. Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB), issued this statement just last week:

“Failures by mortgage servicers and regulators worsened the impact of the economic crisis a decade ago. Regulators have learned their lesson, and we will be scrutinizing servicers to ensure they are doing all they can to help homeowners and follow the law.”

2. Rising Mortgage Rates Will Slow the Housing Market

Another topic generating frequent negative headlines is the recent rise in mortgage rates. While this is a normal happening, some people are expressing concern that these rising rates will negatively impact the housing market by causing home sales to dramatically decline.

Once again, some truth, but mostly not. These misleading headlines are raising unneeded alarm bells.

To debunk them a bit, one must take a look at what history shows us.

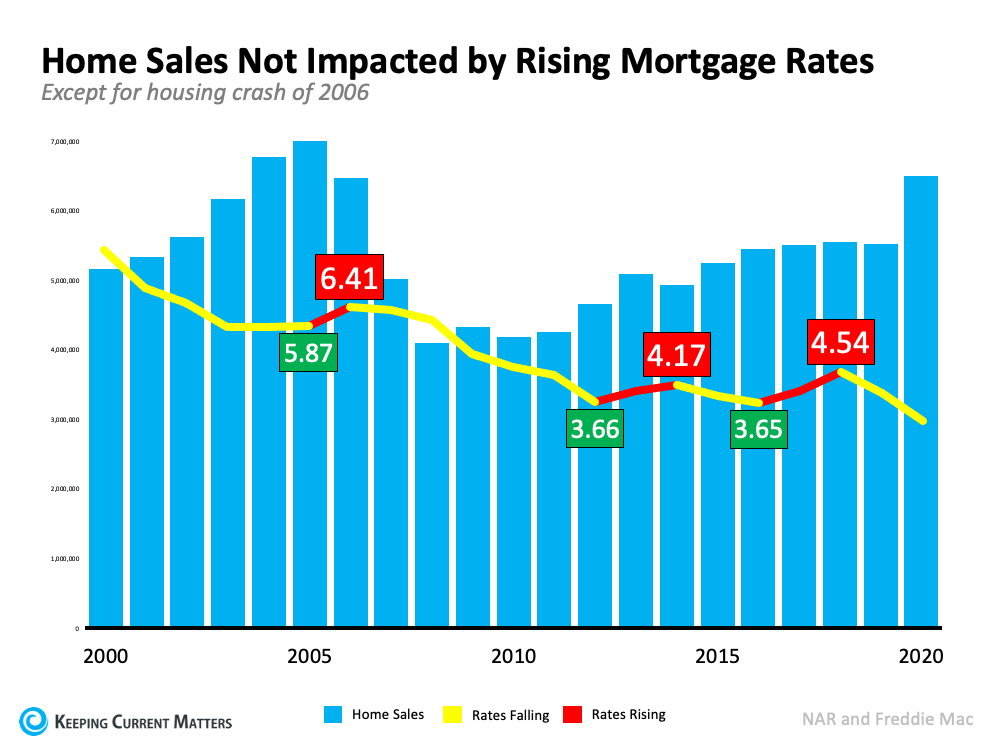

Looking at data spanning the last 20 years, there’s no evidence that an increase in rates dramatically forces sales to come to a halt. In tandem, nor does home price appreciation come to a screeching halt.

Looking at home sales first:

The last three times mortgage rates increased (shown in the graph above in red), sales (depicted in blue in the graph) remained more or less consistent. Yes, it’s true that sales fell dramatically from 2007 through 2010 in the housing market bust, but mortgage rates were also falling at the time.

The next two instances showed no meaningful drop in sales.

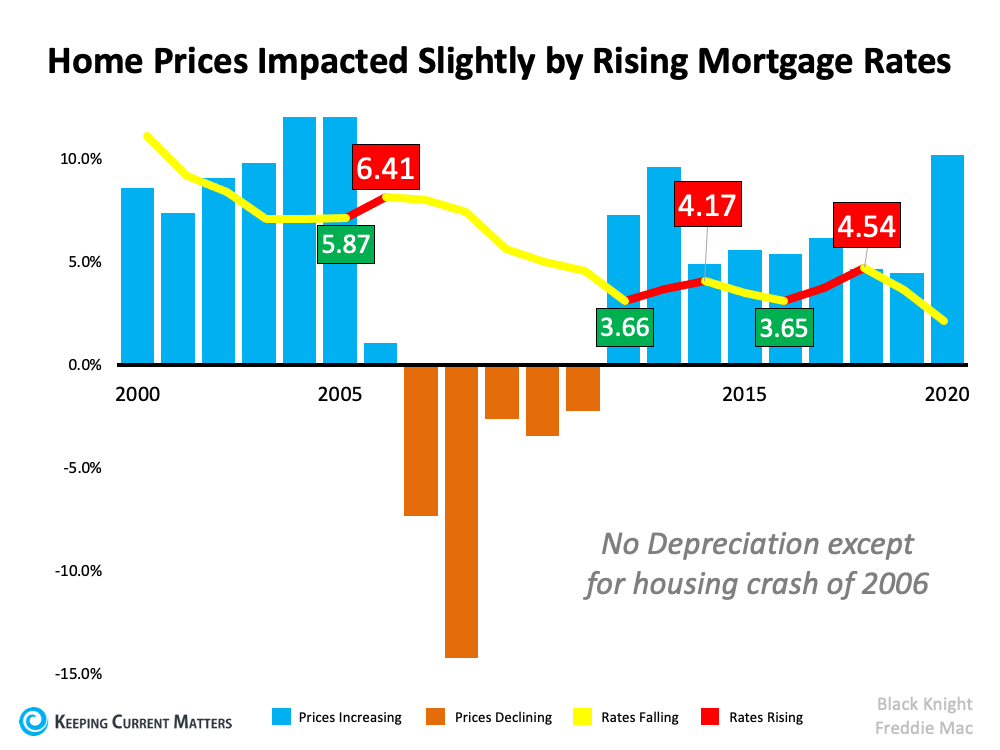

Looking at home price appreciation: (see graph below)

Once again, we see a rise in rates did not cause prices to depreciate.

Outside of the years following the 2008 market crash, home prices continued to appreciate albeit at a slower rate.

There you have it.

With the sheer amount of misinformation out there, it’s so easy to get lost in the overwhelming amount of negative reporting and forecasting.

We’re here to balance it out for you – with factual and evidence based data.

What are you waiting for?

Give Catherine or Tiffany a call today!